Choose the Right Electronic Payment Method

E-wallet is a tool allowing the user to store monetary value and acts as a medium for payment for goods and services or money transfer. With the growing popularity of electronic wallets, they are not only used as a payment tool locally but have also become one of the payment methods for Hong Kong residents in Mainland China.

Due to the increasing maturity of electronic wallets, even Octopus, commonly used by Hong Kong residents, can now be used for payments in Mainland China. However, it's important to note that electronic wallets capable of cross-border transactions (such as WeChat Pay HK and Alipay HK) must undergo real-name authentication to be used for cross-border payments in Mainland China. Additionally, they must be linked to a Hong Kong bank account or Hong Kong credit card (top-up via credit card generally incurs a 1.5%-2.5% handling fee), and the account balance is converted to RMB for QR Code-based electronic payments.

Cross-border payments can be made directly using Hong Kong electronic wallets at Mainland Chinese merchants. Additionally, the "Cross-border Ride Code" can be used to pay for transportation fares in Mainland China, including frequently used services by Hong Kong residents such as the Shenzhen Metro, Guangzhou Metro, and DiDi ride-hailing. It is simple to apply for E-wallet. It only requires the applicant to provide basic personal information such as phone number and email address, then set up a transaction password and complete identity verification, then add a bank account or credit card for top-up purposes. Currently there are six popular E-wallets in Hong Kong. Each of them has its own unique characteristics and function. For example, some E-wallets support cross-border remittances, while others allow users to pay for daily transportation expenses.

-

PayMe (Only supports transactions in Hong Kong dollars)

-

Octopus (Supports cross-border payments in Mainland China)

-

AlipayHK (Supports cross-border payments in Mainland China)`

-

WeChatPay HK (Supports cross-border payments in Mainland China)

-

e-CNY (Supports cross-border payments in Mainland China)

-

Tap&Go (Supports cross-border payments in Mainland China)

PayMe (Click here to visit the official website)

Payme is an electronic payment tool developed by HSBC. However, its usage is not limited to HSBC bank account holders. PayMe currently only supports transactions in Hong Kong dollars. Users can add funds to their PayMe balance through a credit card or by linking a bank account. These funds can then be used to make payments in stores or transfer money to other PayMe or FPS users. You do not need to be an HSBC customer to use PayMe; anyone with a valid Hong Kong ID card and a specified local bank account or credit card can register and use PayMe for free. To enhance security, users must undergo identity verification. Unverified users will not be able to receive any funds.

PayMe Application Steps:

PayMe Application Steps:

-

Download and install PayMe from Google Play Store or Apple App Store.

-

Open the app and register using your mobile number to receive a verification code.

-

Provide personal information and verify your email address.

-

Set a 6-digit transaction password and upload your ID card or HSBC credit card via the app.

-

Add a bank account or credit card to your PayMe account.

Top-up methods:

-

After adding a new credit card or bank account, click on the "My Account" button on the homepage and select "Value Added".

-

Enter the amount to be added.

-

Enter the transaction password.

-

After the value-added process is completed, the record of this transaction will be displayed in the transaction history, and the account balance will also be updated.

Octopus Wallet (Click here to visit the official website)

Octopus Wallet, also known as Octopus O!ePay, is a network-based stored value service operated by managed by Octopus Cards Limited, that supports peer-to-peer payments, online payments and top-ups to Octopus cards.

Users can top-up their Octopus Wallet through their Octopus cards, or by cash at any 7-11 store. They can also transfer money from Octopus Wallet to their bank accounts anytime. In addition to using Alipay and WeChat Pay electronic wallets, the Octopus App has launched a new feature called "Octopus Wallet Pro". One of its significant features is the addition of the "Mainland China" wallet option, which can be used for domestic consumption within China. What's more, the activation process is simple, and there's no need to link a China’s domestic bank account—it settles directly in Hong Kong dollars.

The procedure to open an Octopus Wallet account is as follows:

The procedure to open an Octopus Wallet account is as follows:

-

Download the Octopus app for free from the App Store or Google Play Store.

-

Choose to apply for an account.

-

Enter your mobile phone number. You will receive a one-time SMS password.

-

Set up your personal password.

-

Enter your name and email address. You can choose whether to verify your email address instantly.

-

Complete the account opening process!

Once these steps are completed, you should have successfully opened your Octopus Wallet account.

To activate the Octopus Wallet Pro and complete identity verification, follow these steps:

-

Take a photo and upload your identity card and personal information for verification.

-

Complete the identity verification process by taking a facial photo with your phone for facial recognition.

-

Provide your personal address and other relevant information. The system will process your application immediately.

-

Verification is typically completed within 1 minute.

-

On the main page, select "UnionPay QR Code Payment" and click "Activate Now".

-

The system will send a verification code. After verification, you will receive the UnionPay QR Code, which you can use in Mainland China.

To activate your Octopus Wallet Pro and use it with the UnionPay QR Code for payments in Mainland China.

Top-up methods: After activation, you can top up your account through "FPS" (Faster Payment System) or online banking transfers.

Alipay is highly popular in Mainland while its popularity in Hong Kong is also increasing. Alipay supports cross-border payment services and payment for transportation and other daily expenses. Users can top-up their Alipay account through cash, credit card and bank transfer.

• AlipayHK Identity Verification

• AlipayHK Identity Verification

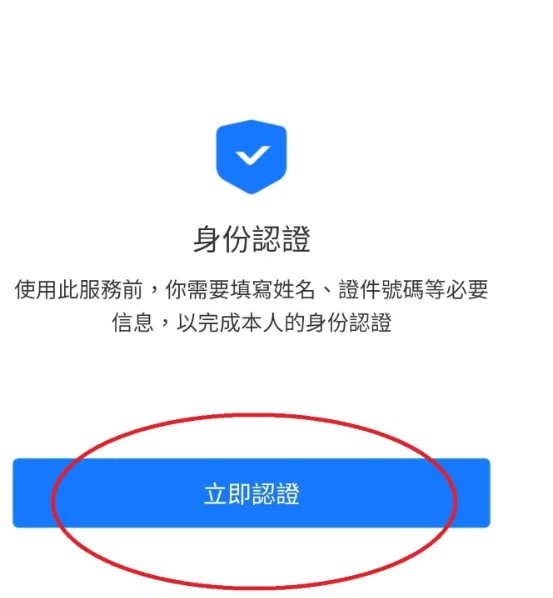

AlipayHK users need to complete intermediate or higher level identity verification to enable cross-border payments:

-

Open the AlipayHK electronic wallet, click on the menu icon at the top left corner, select "Identity Verification," and start the verification process.

-

Follow the on-screen instructions to take a photo of your Hong Kong identity card and confirm the information on the card.

-

Complete the facial recognition process to ensure that the person undergoing verification is the holder of the identity card.

-

After submitting all necessary information, AlipayHK will complete the verification process within approximately 7 working days.

• Add a Hong Kong Bank Account or Hong Kong Credit Card

-

Open Alipay HK and click on "My Wallet" at the bottom right corner.

-

Select "Add Bank Account/Credit Card".

-

Enter the details of your Hong Kong bank account or Hong Kong credit card, including the account number, expiration date, CVV code, etc.

-

You will receive a one-time verification code via SMS on the phone number registered with the bank. Follow the instructions to complete the binding process.

Top-up methods: You can add value by using a credit card, bank direct debit authorization (eDDA), online banking transfers, or by visiting designated stores (such as 7-Eleven, OK Convenience Stores, Watsons, Fortress, McDonald's, or PARKnSHOP). Simply present the QR code to the staff for cash top-up.

WeChatPay HK (Click here to visit the official website)

WeChatPay is the payment function of the mobile application WeChat. By selecting “Pay” in WeChat, users can easily transfer money to any friends in their address book. In addition to payment between friends, WeChatPay is widely accepted among merchants. When making purchases in Mainland, WeChatPay will automatically convert RMB into HKD at a designated exchange rate.

To set up WeChat Pay HK (Hong Kong version), you first need to bind a Hong Kong bank account or Hong Kong credit card. Once successfully set up, you can use Hong Kong dollars within Hong Kong and accept WeChat Pay HK for online or in-store purchases at participating retailers.

• Add a Hong Kong Bank Account or Hong Kong Credit Card to WeChat Pay:

• Add a Hong Kong Bank Account or Hong Kong Credit Card to WeChat Pay:

-

Open WeChat and tap on "Me", then select "Wallet".

-

Tap on "Cards".

-

Click on "Add Card".

-

Select "Add Bank Account/Credit Card".

-

Enter the details of your Hong Kong bank account or Hong Kong credit card, including the account number, expiration date, CVV code, etc.

-

Set a six-digit payment password.

Following these steps will allow you to successfully bind your Hong Kong bank account or credit card to WeChat Pay for transactions within Hong Kong.

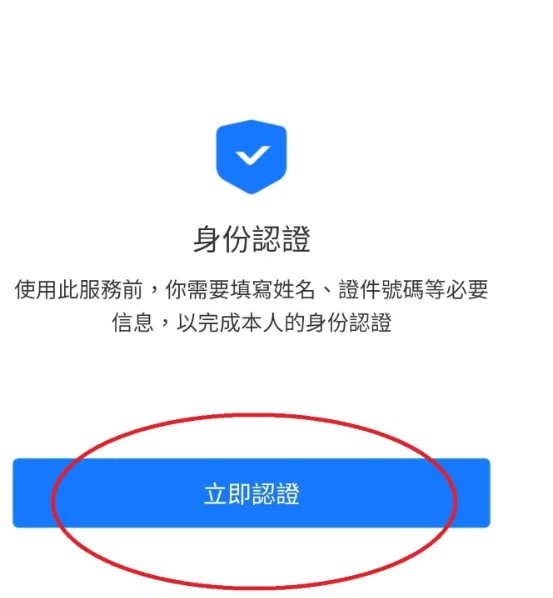

• WeChat Pay HK Identity Verification

To enable two-way cross-border payments and use the WeChat Pay HK wallet for payments within Mainland China, you need to complete identity verification. Once verified, you can directly use WeChat Pay HK to make payments in Mainland China using Hong Kong dollars. Additionally, you can take advantage of preferential exchange rates for converting Hong Kong dollars to Chinese yuan.

-

Open WeChat and tap on "Me". Select "Wallet" and then "Payment Management".

-

Choose "Real Name Verification" to begin the identity verification process.

-

Follow the prompts to enter your personal information, including your name, Hong Kong identity card number (for Hong Kong residents only), and scan a copy of your identity document.

-

Verify your payment password (if required).

-

Verify your mobile phone number (to receive verification codes), confirm your personal information, and fill in your address details.

-

Perform facial recognition (ensure good lighting).

-

You will be notified of the verification results within 7 working days.

Top-up methods: Use a credit card, bank direct debit authorization (eDDA), or visit designated stores (7-Eleven convenience stores, OK convenience stores, and McDonald's) where you can show the staff a QR code to add cash value.

e-CNY(Click here to vist the offical website)

Digital Currency Electronic Payment (e-CNY) is the digital form of the legal tender issued by the People's Bank of China. The e-CNY wallet can be used for cross-border payments (pilot areas in Mainland China include 17 provinces and 26 regions), but it cannot be used for peer-to-peer transfers (Hong Kong pilot supports each Hong Kong mobile number to open a personal e-CNY wallet belonging to the fourth category at each operator). Compared to WeChat Pay and Alipay, e-CNY has unique advantages such as not requiring a bank card to be linked and supporting offline payments using mobile NFC functions in areas without network coverage, making it particularly suitable for remote regions. While e-CNY, WeChat Pay, and Alipay are all payment tools, they differ fundamentally. WeChat Pay and Alipay are electronic payment tools issued by third-party payment institutions, whereas e-CNY is the national digital currency issued by the People's Bank of China. Digital Currency Electronic Payment (e-CNY) serves as the legal tender base currency, and recipients are not permitted to refuse it.

There are redemption arrangements for e-CNY, allowing users to exchange the digital currency in their wallets for cash at designated branches of Hong Kong subsidiary banks of their wallet operators. Currently, there are 17 Hong Kong banks that provide value-added services for e-CNY wallets via "Faster Payment System" (FPS), among which 6 support funding from RMB accounts. Additionally, 11 banks support direct exchange from users' HKD accounts to increase the value of e-CNY wallets, with exchange rates displayed in real time for user reference.

Banks that support funding from RMB accounts:

Banks that support funding from RMB accounts:

-

China CITIC Bank International Limited

-

Chong Hing Bank Limited

-

Dah Sing Bank Limited

-

DBS Bank (Hong Kong) Limited

-

Fubon Bank (Hong Kong) Limited

-

ZA Bank Limited

Banks that support funding from both RMB and HKD accounts:

-

Livi Bank Limited

-

Bank of China (Hong Kong) Limited

-

Bank of Communications (Hong Kong) Limited

-

The Bank of East Asia, Limited

-

China Construction Bank (Asia) Corporation Limited

-

CMB Wing Lung Bank Limited

-

Fusion Bank Limited

-

Hang Seng Bank Limited

-

The Hongkong and Shanghai Banking Corporation Limited

-

Industrial and Commercial Bank of China (Asia) Limited

-

Standard Chartered Bank (Hong Kong) Limited

Download and Registration:

The official application is named "Digital Renminbi" (e-CNY). Users can search for the keywords "e-CNY" or "Digital Renminbi" in smartphone app stores (including Google Play and Apple App Store) to download and install the e-CNY wallet application. Users only need to register with their Hong Kong mobile number and then select the wallet of their preferred operating institution.

Top-up methods:

-

Click on "Top Up Wallet" and enter the amount to be added, then click "Next".

-

Select "Faster Payment System (FPS)" as the payment method.

-

Click "Pay Now" and choose a Hong Kong mobile bank that supports the payment.

-

The page will automatically redirect to the chosen mobile banking application.

-

Select the withdrawal account.

-

Follow the usual payment process to complete the top-up for the e-CNY wallet.

Tap&Go (Click here to visit the official website)

Tap&Go, operated by Hong Kong Telecom, incorporates both Mastercard and UnionPay card schemes. It is a prepaid payment tool that can be used in shops which accept Mastercard or UnionPay. Users need to download the “Tap&Go” to their smartphones and activate the account through phone number and identification documents. If needed, users can also apply for a physical card on top of the virtual card. The Tap & Go mobile wallet can be used at over 6 million physical stores and online merchants worldwide, including MasterCard® Contactless and UnionPay QuickPass contactless payments. Additionally, you can make payments using QR codes. For even greater convenience, you can link your Tap & Go card to Apple Pay, Google Pay, or Huawei Pay, making payments even simpler and more convenient!

Tap & Go Payment Methods:

-

Open the Tap & Go app and tap on "Go QR".

-

Present the QR code for the merchant to scan.

-

After the transaction is successful, you will receive a notification on your phone.

To pay by scanning the merchant's QR code:

-

Open the Tap & Go app, tap on "Go QR" and select "Scan".

-

Scan the merchant's Go QR code or the "Faster Payment System" HKQR code.

-

Enter the payment amount and password, then tap "Confirm" to complete the payment.

-

After the transaction is successful, you will receive a notification on your phone.

Add to Digital Payment Platforms

-

Apple Pay and Google Pay: Add your Tap & Go i.Card to your Apple Pay Wallet or Google Pay to make payments at physical stores and online through Apple Pay or Google Pay (note: Google Pay currently does not support Tap & Go UnionPay cards).

Top-up methods:

-

Faster Payment System (FPS) - Instantly transfer funds to your Tap & Go account using just a phone number or email address from any bank or electronic wallet.

-

Bank Transfer - Transfer funds via online banking platforms such as Bank of China (Hong Kong), HSBC, and Hang Seng Bank. The website will automatically link you to the specified bank's online banking page for the transfer.

-

Cash Top-up - Increase value at designated merchant stores. Each top-up must be in multiples of HK$50, with a daily maximum cash top-up limit of HK$3,000. Designated merchants include: HKT, 1010, CSL, 7-Eleven convenience stores, OK convenience stores, 759 Store, SUN MOBILE, PARKnSHOP, HEYCOINS, and PayMe, etc.